Our computation engine can only calculate ownership accurately if you have named parties accurately in each instrument.

This list of best practices will help you accomplish 3 goals:

- Sometimes the same party owns interests in different capacities. In those cases, we have to give Tracts a way to identify and calculate those interests separately.

- It’s also important to let Tracts know when 1 party is named in multiple ways but owning in the same capacity.

- Standardized naming also helps reviewers and clients quickly track interests throughout your chain.

Parties & Aliases Tool

The Parties & Aliases tool is one of the most important features in the Tracts software. Its main purpose is to accurately calculate and convey the interests of entities named differently throughout title when those parties are one and the same entity.

The simplest use of this tool is to merge an individual’s name with any known aliases.

For example, if instruments identify John Smith, John A. Smith, Jonathan Smith, and John Aaron Smith as the same party, enter:

Primary Party: Jonathan Aaron Smith

Aliases: John Smith, John A. Smith, Jonathan Smith, and John Aaron Smith

This way, you’ll be able to enter any of the above names, as stated in a conveyance, and Tracts will accurately calculate the ownership change created by that conveyance.

When an alias is created, leave any pertinent notes for reviewers, both in the notecards where the party exists and in the Parties & Aliases Tool.

Further instructions regarding the Parties & Aliases Tool can be found here.

Husband and Wife

Enter husbands and wives as two separate parties, even if you believe they own the property as community property.

For example, if a document names “John Smith and Jane Smith, his wife” as Grantee, enter two separate Grantee lines, as follows:

John Smith

Jane Smith, wife of John Smith

Sole and Separate Property

In community property states (AZ, CA, ID, LA, NM, NV, TX, WA), property that either spouse acquires during the marriage is owned in equal parts, unless it is acquired in any of the following ways:

As an heir, whether by will or intestate succession;

By gift, often containing language like “for the love and affection…”;

Purchased with sole and separate funds.

Name grantees who are acquiring separate property by adding “, SSP”.

For example, if John Smith acquires a portion of his father’s estate by intestacy, enter his name on the Grantee line as follows:

John Smith, SSP

Joint Tenants

Enter Joint Tenants on the same line, followed by JT or JTROS (if the right of survivorship is stated).

If a deed names Grantees, “John Smith and Jane Smith, husband and wife, as joint tenants”

John Smith and Jane Smith, JT

If a deed names Grantees, “John Smith and Jane Smith, husband and wife, as joint tenants with the right of survivorship”

John Smith and Jane Smith, JTROS

*Treat all joint tenants as owning the right of survivorship, unless otherwise stated in the instrument or otherwise advised by a client or manager.

Tenants In Common

Tenancy in Common is implied when multiple owners own the same property, unless some other type of ownership is stated.

No particular annotation should be added to the grantees’ names when they are named TIC or tenants in common.

Tenants by Entirety (WY and ID)

If parties acquire an interest in WY as husband and wife, it is implied that they are TBE. Name them as follows:

“John Smith and Jane Smith HWTBE”

Life Estates

In the video example above, the instrument at Book 22, Page 222 vests a life estate in Betty Smith, and the remaindermen are Charles Smith and David Smith. Therefore, you would enter Grantees as follows:

- Betty Smith, LE (22/222)

- Charles Smith, Remainderman (22/222)

- David Smith, Remainderman (22/222)

Betty Smith, LE (22/222) will receive the entire interest at that point.

Do not enter any interest for the remaindermen.

Flag this card as a Reversion.

Upon finding a death record for the life tenant:

- Enter a separate card, effective upon that DOD.

Grantors: Life Tenant and any Remaindermen, as named in the previous card.

Grantees: Remaindermen, owning as SSP, not in a remaindermen capacity.

- Remove the Reversion flag from the card that established the life estate.

Trusts

When a grantor or grantee in an instrument is identified as a trust, name the trust, following this convention:

John Doe, Jr., John Boltz, and Jessica Boltz, Co-Trustees of the John Doe Family Trust, FBO Jane Doe, dated 1.1.1992

The naming convention above was revised on 9/16/2021.

The examples below present important concepts but include an outdated naming convention.

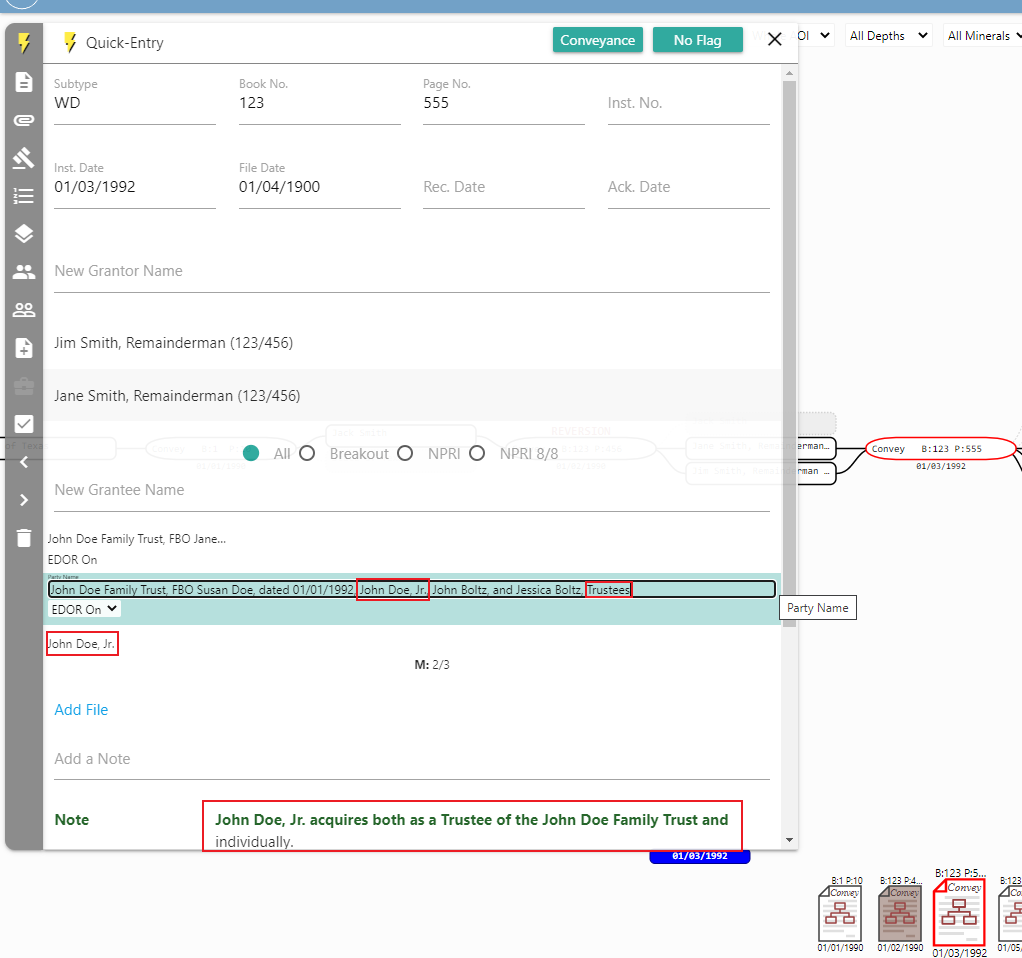

Keep parties separate when they are acting individually and as Trustee.

Keep parties separate when they are beneficiaries of the same Trust–this will be indicated by the words “for the benefit of” or “FBO”.

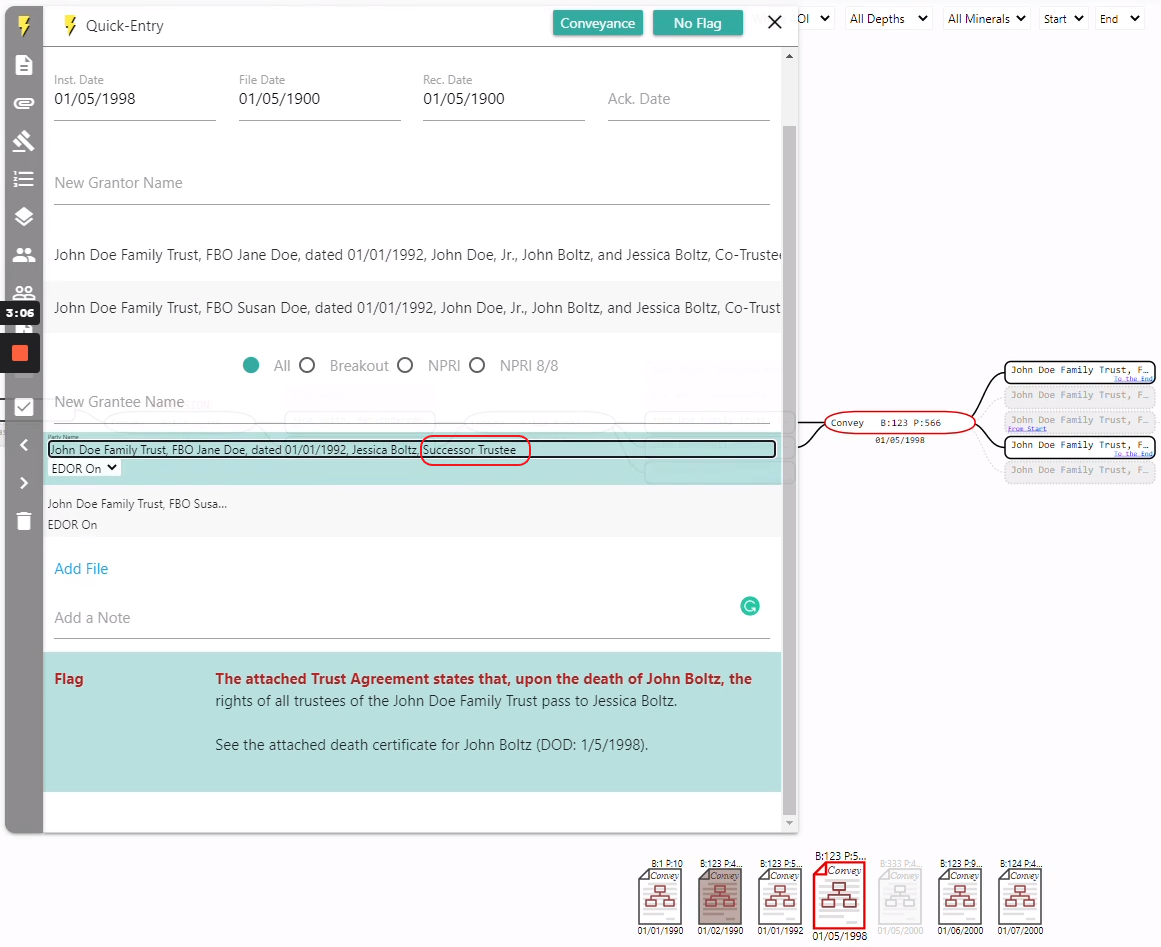

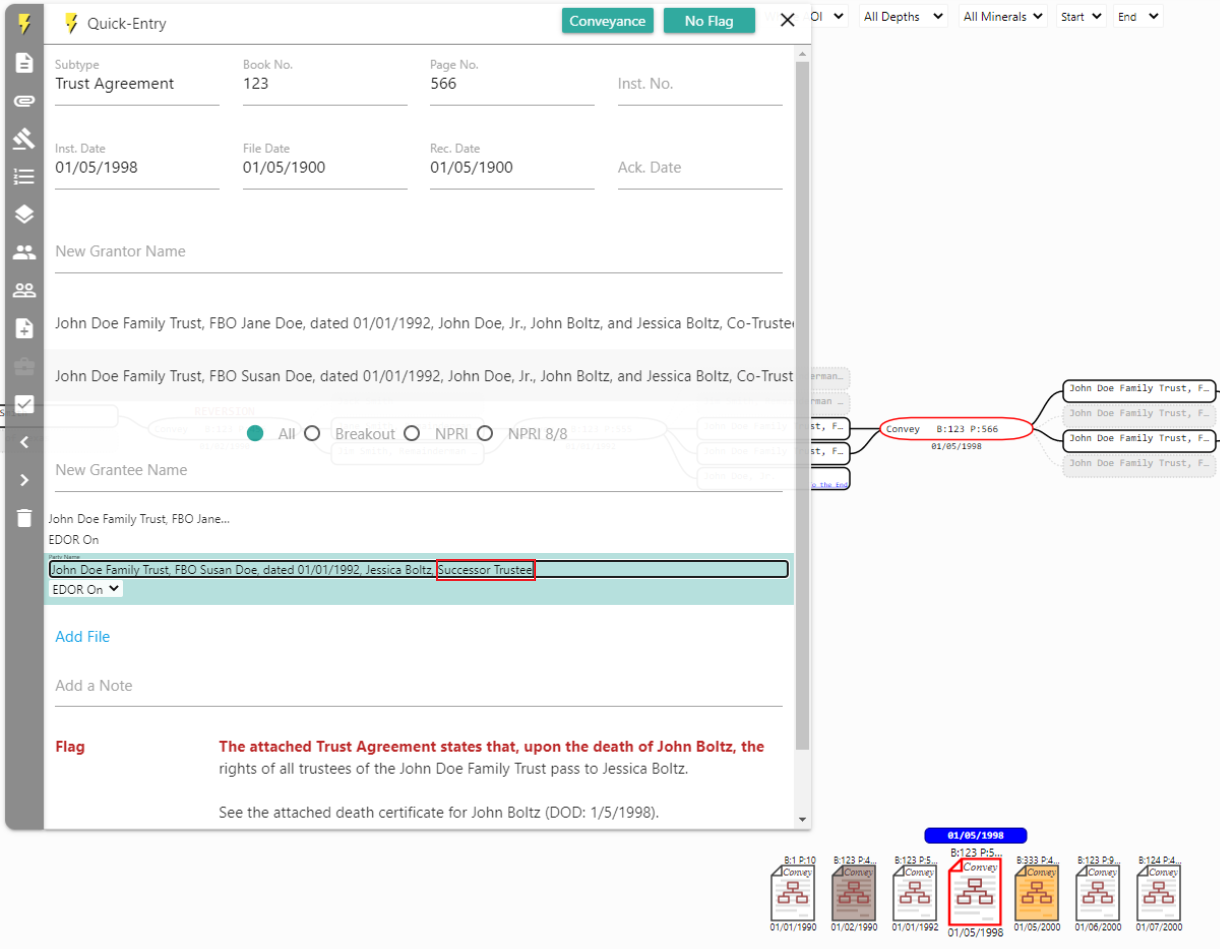

Include any instruments that transfer interest into successor trustees as separate notecards in your chain of title.

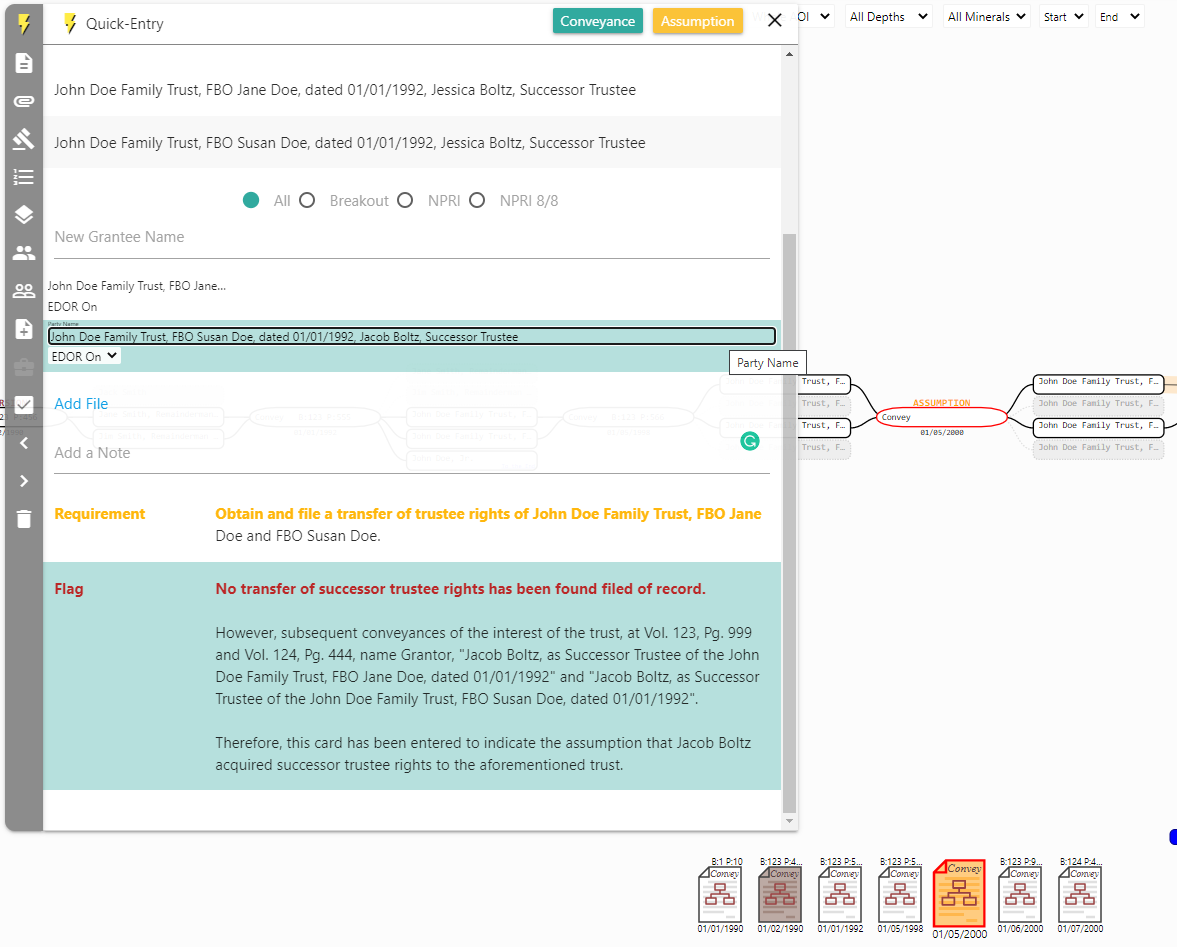

In some cases, a Successor Trustee will convey an interest of a trust, but you will not find a document whereby the Successor Trustee acquired that right. In such cases, you will need to enter an Assumption card reflecting the passing of rights of the Trustee.

You will also need to note this assumption within the digital notecard.

Governing Bodies

As a general rule, an agent acting on behalf of a governing body should be entered as an alias of that body.

For example, if multiple Sheriffs act as Sheriff of Tarrant County throughout your chain of title, enter the “Tarrant County Sheriff” as the primary party name and any of those Sheriffs’ names should be entered as aliases.

Other Notes

“The” is only included in names of corporations–not in names of estates, trusts, etc.

Add a space and a period after each initial.